|

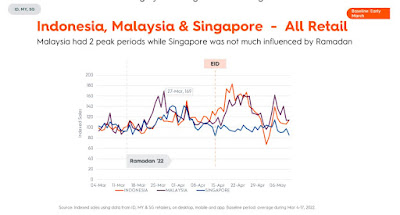

| Source: Criteo. Malaysia had two peaks in shopping over Ramadhan whereas Singapore was largely unaffected. |

Criteo, the commerce media company, has shared advice on how to capitalise on commerce

opportunities during Ramadhan this year.

The company notes that consumers are excited to resume their daily activities post-pandemic, and would like to go back to their old ways of celebrating festivals with their families and friends. However, inflation and the rising cost of living are impacting consumer behaviour.

Ramadhan occurred 2 April – 1 May in 2022. Based on Criteo's retail data from last year’s Ramadhan*, initial online sales in Southeast Asia saw a 19% increase in early April 2022 compared to the last two weeks of March 2022. Sales figures continued rising during Ramadhan until approximately one week before Eid (early May) across markets in the region.

Indonesia experienced the sharpest increase in sales, at 74%, on April 20, 2022. Indonesia saw increasing sales which began around March 23, indicating that Indonesians might have been shopping to prepare for Ramadhan. Indonesia saw a spike of 68% a week before Eid.

Malaysia witnessed two peaks, on 4 April (a double day sale, 4.4) and 22 April respectively. Malaysia had a 35% increase six days before Eid in retail sales.

Singapore consumers continued with their usual shopping habits, suggesting that their retail habits remained largely unchanged even during Ramadhan. However, both Indonesia and Malaysia are Muslim countries, whereas Muslims are a minority in Singapore.

Apparel & Accessories was the top performing product category and saw a 30% increase in sales during Ramadhan. Other product categories that performed well were Health & Beauty, Home & Garden and Electronics, which all saw an 18% increase in retail sales right before Eid. Additionally, travel sales saw a general increase and peaked (+44%) four days before Eid celebrations. This might be expected as people want to travel home to gather with their family and friends for the celebration, Criteo noted.

Ramadhan also saw a change in the patterns of online shopping, especially in Indonesia and

Malaysia:

Online sales at night saw a general positive trend that started from 19:00 (Indonesia), 20:00

(Malaysia) and continued till the morning.

Online shopping before dawn 04:00 – 05:00 (Indonesia), and 05:00 – 06:00 (Malaysia) saw the

highest change during Ramadhan as compared to the normal days’ performance (March 1 – 30). This ties in with people being up before dawn for suhoor, the pre-dawn meal.

Decreased sales events during iftar (breaking of fast) 18:00 – 19:00 (Indonesia), more than

on regular days (no requirement to eat at sunset).

12:00 – 13:00 in both countries stands out as the time with the highest number of sales during

the day. Consumers were shopping more as they were fasting during the lunch hour, instead of having lunch, Criteo noted.

“With inflation being at the forefront of the mind of consumers coupled with the change in consumer

behaviour during Ramadhan, it is vital for marketers to rethink their advertising strategies in order to

maximise their outreach across various platforms,” said Taranjeet Singh, Criteo's MD for South APAC.

“Last year’s data revealed a change in the patterns of online shopping during Ramadhan, with an increase in online sales at night and before dawn. Marketers should take note of these trends and

ensure that their advertising strategies are tailored to the specific times when consumers are most active online.”

Criteo has three tips that will enable retailers to capitalise on opportunities for Ramadhan 2023:

Rise of commerce media – commerce media is being positioned as the 4th wave of digital

advertising and has the power to reach and engage consumers where they’re actively browsing

and buying. According to McKinsey, commerce media is a

new form of advertising "that closes the loop between media impressions

and commerce transactions to improve targeting, provide new audience

insights, and deliver more relevant and valuable experiences for

consumers."

Criteo’s Rise of Savvy Shopper Study* shows that 71% of global shoppers are spending more time online to search for the best offers and values before making a purchase. As shoppable moments can happen in nearly any environment, emerging environments such as retail media will continue gaining traction in 2023. Savvy retailers will need to continue expanding their media offerings to own their end-to-end customer journey, and marketers will keep investing in retail media because it works.

Understanding the optimal timings – shoppers are still finding ways to buy what they love,

regardless of inflation. Consumers are spending more on non-negotiables like mortgages or food

and have developed a more forward-thinking mindset that accelerated some purchases, such as buying

essential items in bulk to get more value for their money.

At the same time, a majority are still purchasing the goods and experiences they want most. Nearly three quarters (74%) of consumers globally said they’re spending the same or more on personal care/health and beauty products, followed by apparel and accessories (65%), consumer electronics (63%). Marketers should take note of the change in the pattern of online shopping during Ramadhan, especially the vital hours where sales generally increase, to tap into the spending habits of consumers.

Incorporating quality and loyalty programmes - despite saving money being top of mind,

consumers believe that deals should not come at the expense of quality. Almost all (91%) global consumers chose product quality as the biggest factor influencing purchase decisions, ahead of free shipping (90%) and discounts and coupons (84%).

They also value the alignment with brand values such as ecofriendliness and loyalty programmes. Marketers can tap on this by ensuring that their

products are top notch and creating loyalty programmes that motivate consumers to continue

purchasing from them, Criteo said.

*Methodology for Ramadhan data and The Rise of Savvy Shoppers

All insights represent the organic events from partners and are agnostic of any Criteo attribution.

Times reported are local times, (i.e., 7 hours added to UTC timestamp to the events retrieved from Indonesian retailers)

Retail data is indexed per each partner and then aggregated by taking the mean.

Each insight is backed by at least five partners in the given market (country/region-vertical).

Southeast Asia is defined as Indonesia, Malaysia, Singapore, the Philippines, Vietnam and Thailand for producing the product category and travel trends in order to reach a minimum sample size.

Criteo surveyed 13,829 consumers in Australia, France, Germany, Italy, Japan, South Korea,

Spain, the UK and the US for The Rise of Savvy Shoppers. The field work took place between November 20 and December 13, 2022.